The Of 501c3 Organization

Wiki Article

501c3 for Dummies

Table of Contents7 Easy Facts About Non Profit Organizations List ShownWhat Does 501 C Mean?Facts About Not For Profit UncoveredThe Only Guide for 501c3The Facts About Non Profit UncoveredAll About 501c3The Ultimate Guide To 501c3 NonprofitNon Profit Organizations Near Me Things To Know Before You Get This

Unlike several various other types of donating (through a phone telephone call, mail, or at a fundraiser event), contribution pages are very shareable. This makes them perfect for increasing your reach, as well as consequently the number of donations. Contribution pages enable you to collect and also track data that can educate your fundraising method (e.The Best Strategy To Use For Not For Profit

donation size, when the donation was made, who donated, how muchJust how how they exactly how to your website, etc) Finally, lastly pages make it convenient and practical and also basic donors to benefactors!Be sure to gather email addresses and also various other appropriate data in a proper means from the start. 5 Take care of your individuals If you haven't tackled working with as well as onboarding yet, no concerns; now is the time.

6 Simple Techniques For Npo Registration

Right here's just how a not-for-profit used Donorbox to run their campaign as well as obtain contributions with an easy yet well-branded web page, optimized for desktop as well as mobile - 501c3 organization. Choosing a funding model is crucial when starting a nonprofit. It depends upon the nature of the nonprofit. Below are the different sorts of financing you may want to think about.As a result, nonprofit crowdfunding is getting the eyeballs these days. It can be utilized for particular programs within the organization or a basic donation to the cause.

Throughout this action, you could desire to consider milestones that will indicate an opportunity to scale your not-for-profit. As soon as you have actually run awhile, it's vital to take some time to consider concrete development objectives. If you haven't currently produced them during your preparation, produce a set of essential efficiency signs and landmarks for your not-for-profit.

The Main Principles Of 501c3 Organization

Resources on Starting a Nonprofit in various states in the US: Beginning a Nonprofit FAQs 1. How much does it set you back to start a not-for-profit company?How much time does it take to set up a not-for-profit? Depending upon the state that you're in, having Articles of Incorporation accepted by the state government may occupy to a few weeks. Once that's done, you'll have to request acknowledgment of its 501(c)( 3) condition by the Internal Profits Service.

With the 1023-EZ kind, the processing time is commonly 2-3 weeks. Can you be an LLC as well as a not-for-profit? LLC can exist as a not-for-profit restricted liability business, however, it must be completely had by a solitary tax-exempt not-for-profit organization.

The smart Trick of Non Profit Org That Nobody is Discussing

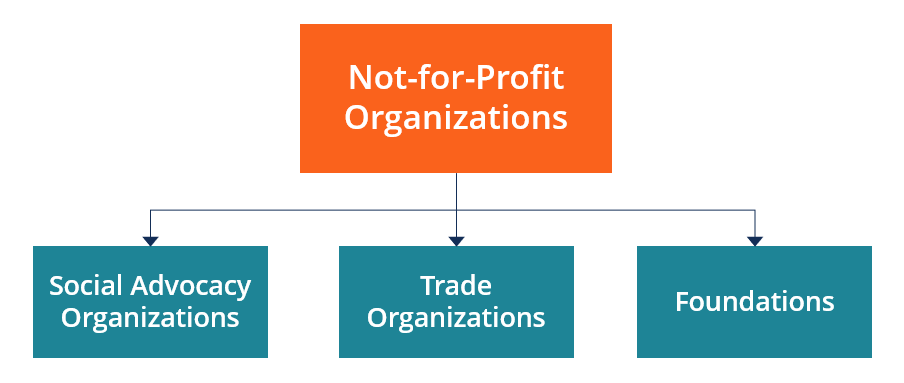

What is the distinction between a foundation and also a not-for-profit? Structures are normally funded by a family or a company entity, however nonprofits are funded through their earnings as well as fundraising. Foundations generally take the cash they began with, spend it, and afterwards disperse the cash made from those investments.Whereas, the additional money a nonprofit makes are made use of as operating prices to fund the organization's goal. Is it hard to begin a not-for-profit organization?

Although there are numerous steps to start a nonprofit, the obstacles to entry are fairly few. 7. Do nonprofits pay tax obligations? Nonprofits are excluded from government income taxes under area 501(C) of the internal revenue service. There are particular circumstances where they may require to make repayments. For example, if your nonprofit earns any type of revenue from unrelated activities, it will owe earnings tax obligations on that particular quantity.

How Non Profit Organizations Near Me can Save You Time, Stress, and Money.

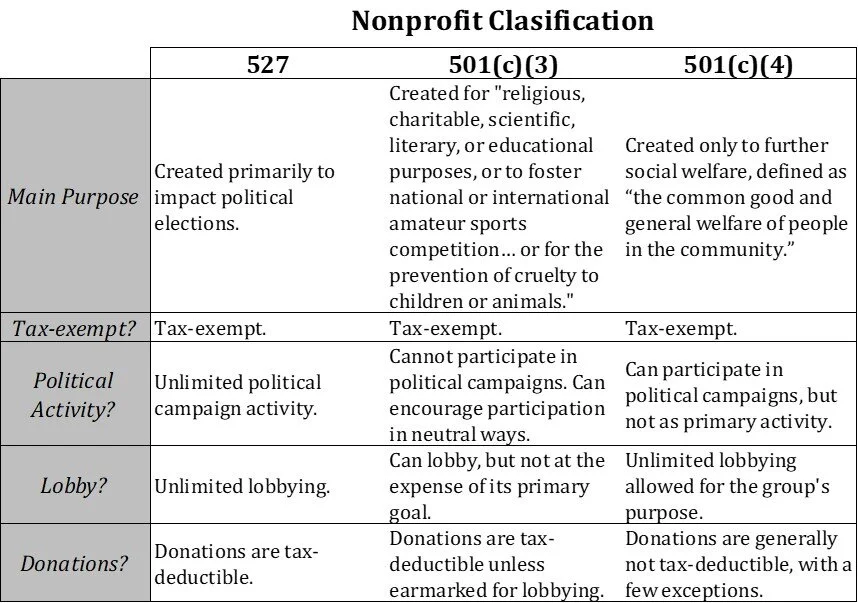

The duty of a nonprofit company has always been to develop social modification and also lead the means to a better world., we focus on remedies that assist our nonprofits raise their venmo nonprofit donations.Twenty-eight various kinds of not-for-profit companies are identified by the tax legislation. By far the most typical type of nonprofits are Section 501(c)( 3) companies; (Area 501(c)( 3) is the component of the tax obligation code that licenses such nonprofits). These are nonprofits whose goal is charitable, religious, educational, or scientific. Section 501(c)( 3) company have one massive benefit over all other nonprofits: payments made to them are tax obligation insurance deductible by the benefactor.

This classification is essential due to the fact that exclusive structures undergo stringent operating regulations and also guidelines that do not apply to public charities. As an example, go now deductibility of contributions to a private foundation is extra limited than for a public charity, and also exclusive foundations are subject to excise tax obligations that are not troubled public charities.

The smart Trick of Non Profit Organizations Near Me That Nobody is Discussing

The bottom line is that personal foundations obtain a lot even worse tax therapy than public charities. The major distinction in between private structures and public charities is where they get their monetary assistance. An exclusive foundation is generally managed by a private, household, or company, and also gets the majority of its revenue from a couple of benefactors as well as financial investments-- an excellent example is the Bill and Melinda Gates Foundation.This is why the tax law is so difficult on them. A lot of structures just give money to various other nonprofits. Nonetheless, somecalled "running foundations"operate their own programs. As a sensible issue, you require a minimum of $1 million to start a private foundation; otherwise, it's unworthy the problem as well as cost. It's not shocking, then, that a personal structure has been called a large look at here body of money bordered by individuals who want several of it.

Some Known Details About Not For Profit Organisation

If the internal revenue service categorizes the not-for-profit as a public charity, it keeps this condition for its very first five years, no matter the public assistance it in fact gets throughout this time around. Starting with the not-for-profit's sixth tax year, it has to show that it satisfies the general public assistance test, which is based upon the assistance it obtains during the present year and also previous four years.If a not-for-profit passes the test, the internal revenue service will remain to monitor its public charity status after the very first five years by calling for that a finished Set up A be submitted yearly. Learn even more about your nonprofit's tax obligation standing with Nolo's publication, Every Nonprofit's Tax obligation Overview.

Report this wiki page